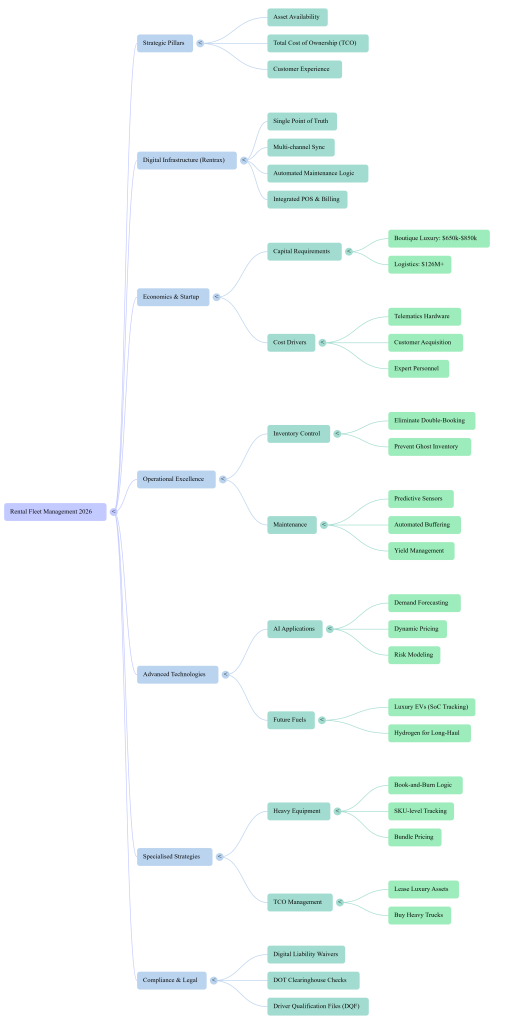

Rental fleet management is the strategic business of acquiring, maintaining, and leasing out vehicle or equipment assets to generate recurring revenue. In 2026, this industry has evolved from simple asset tracking to “localized intelligence.” Success requires balancing three things: Asset Availability, Total Cost of Ownership (TCO), and Customer Experience.

Whether you are renting out luxury sedans, heavy construction “iron,” or e-bikes, you need a centralized operating system. Rentrax serves as this digital backbone. It syncs real-time inventory across all channels to prevent double-booking. Moreover, it automates maintenance logic so you never rent broken gear. It handles complex billing like security deposits and recurring invoices. For a new business in 2026, Rentrax is not just software; it is the infrastructure that allows you to scale without drowning in paperwork.

Phase 1: The Skeleton

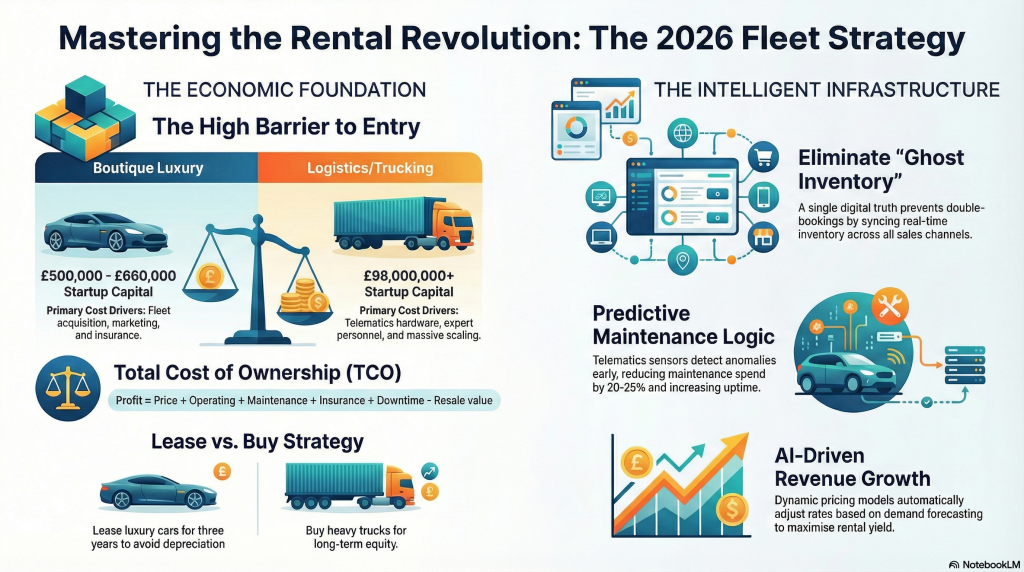

The rental fleet market is projected to reach $122.3 billion by 2035. However, entry is expensive and legally complex. A boutique luxury rental firm requires approximately $650,000 in startup capital. A large logistics operation may need over $100 million.

To succeed, you must eliminate “data silos.” You cannot have your mechanic using one system and your sales team using another. This causes “ghost inventory,” where broken cars are rented out by mistake. Software like Rentrax solves this by acting as a “Single Point of Truth.” It integrates telematics, bookings, and waivers into one view. It uses AI to predict demand and adjust prices dynamically. In 2026, the winner is the fleet that uses data to maximize uptime and minimize risk.

Phase 2: The Core Education

1. The Rental Revolution: From Stacks to Systems

Introduction In the past, running a rental business meant using a whiteboard for bookings and a spreadsheet for maintenance. In 2026, that method is obsolete. The industry has shifted to a “unified system.”

The Evidence The global rental software market is now valued at $14.37 billion. It is growing at nearly 15% every year. This growth drives a shift in how we work. We are moving from fragmented tools to a “strategic infrastructure layer”.

In 2026, you deal with “high-volume” complexity. You might manage 8,000 individual items across five cities. If your software lags by even one minute, you lose money. Rentrax positions itself at the center of this world. It connects the physical asset (the car) to the digital transaction (the payment).

Summary You are no longer just a “rental manager.” You are a tech operator. You need a system that connects every part of your business instantly.

2. The Economics of Starting a Rental Fleet

Introduction Many entrepreneurs underestimate the cost of entry. The barrier to entry in 2026 is high. You need to secure your “runway” before you buy your first vehicle.

The Evidence Let’s look at the real numbers for 2026.

- Luxury/Corporate Fleet: To start a boutique service, you need between $650,000 and $850,000. This covers your initial fleet, insurance, and office.

- Logistics/Trucking: This is a massive undertaking. Industry benchmarks suggest a funded startup needs $126 million to scale to profitability by 2028.

Why is it so expensive?

- Tech Stack: You must spend $120,000 just on telematics hardware for a decent-sized fleet.

- Customer Acquisition: You need $350,000 a year for marketing to find clients.

- Personnel: A core team of experts will cost you nearly $400,000 in salaries for the first few months.

Summary Do not start undercapitalized. You need a budget that accounts for hardware, software, and survival for at least six months.

3. Inventory Control: The "Single Point of Truth"

Introduction The biggest nightmare in rental is the “Double Booking.” This happens when two people book the same car at the same time. Rentrax eliminates this risk.

The Evidence Rentrax uses a “multi-channel synchronization engine”. Imagine this scenario:

- Customer A books a bike online at 10:00 AM.

- Customer B walks into your shop at 10:01 AM wanting the same bike.

- The System: In the old days, you would have an argument. With Rentrax, the system instantly marks the bike “Unavailable” on all screens the second Customer A clicks “Pay”.

This prevents “ghost inventory.” This is when your system says a car is there, but it is actually in the shop or missing. Rentrax uses a color-coded calendar to show the exact status of every item.

Summary Your inventory is your money. Rentrax ensures you never promise an asset you cannot deliver. It keeps your reputation safe.

4. Maintenance as a Revenue Enabler

Introduction In a rental business, a broken car is a liability. It costs you parking space and earns zero dollars. You need to fix it fast.

The Evidence Rentrax links maintenance directly to availability.

- The Trigger: A mechanic logs a repair in the system.

- The Action: Rentrax automatically blocks that vehicle on the booking calendar.

- The Benefit: No sales agent can accidentally rent it out.

The system also uses “Automated Buffering”. It forces a time gap between rentals. If a car returns at 2:00 PM, the system might block bookings until 4:00 PM. This gives you time to clean, inspect, and refuel. This ensures the next customer gets a perfect experience.

Summary Maintenance is not just about fixing things. It is about “yield management.” Automated buffers ensure you have time to turn the car around professionally.

5. The Financial Engine: Getting Paid

Introduction Rental billing is complicated. You have deposits, late fees, and fuel charges. You cannot do this manually.

The Evidence Rentrax has an integrated Point of Sale (POS) system. It connects with Stripe and Square for real-time payments.

- Recurring Billing: Crucial for long-term rentals (like construction). You can set up a monthly invoice that sends itself. This improves your cash flow without effort.

- Security Deposits: The system automatically holds funds on a credit card. If the equipment comes back damaged, you capture the funds immediately.

- Tax Compliance: It handles complex tax rules, including “tax-inclusive” pricing for markets like Europe and Australia.

Summary Automated billing protects your cash flow. It ensures you collect every dollar, including late fees and damages, without awkward confrontations.

6. AI: The New Rental Manager

Introduction In 2026, AI is your business partner. It helps you make decisions that humans might miss.

The Evidence Rentrax uses AI “copilots”. These are not just chatbots. They are data analysts.

- Demand Forecasting: The AI looks at history and seasons. It predicts when you will run out of cars.

- Dynamic Pricing: This is the “Airline Model.” If the AI predicts high demand for the weekend, it raises your rental prices automatically. This maximizes your profit.

- Risk Modeling: The AI analyzes driver behavior. It can predict which renters are likely to cause accidents based on past data patterns.

Summary AI turns your data into profit. It helps you charge the right price at the right time

Phase 3: Deep Dives & Data

Deep Dive 1: The "Book-and-Burn" Logic for Heavy Equipment

If you are in the construction rental business (“Heavy Iron”), generic software will fail you. You need specific workflows.

The Challenge: Construction sites are chaotic. Equipment moves between job sites. It gets dirty and damaged.

The Solution: Rentrax offers “Book-and-Burn” functionality.

- What it is: A site supervisor reserves a bulldozer (Book). They use it for 3 weeks. They track the hours. The hours are deducted from the project budget (Burn).

- SKU Tracking: You don’t just rent “a drill.” You rent “Drill #1234.” This allows you to track the ROI of that specific tool.

The Attachments Problem: You rarely rent just a tractor. You rent a tractor plus a bucket plus a safety kit. Rentrax uses “Bundle Pricing”. It groups these items into one contract. This speeds up the checkout process significantly. It ensures the customer doesn’t leave without the safety gear they legally need.

Key Takeaway: For heavy industry, you need SKU-level tracking and bundling. This ensures you know exactly where every bucket and bolt is located.

Deep Dive 2: Total Cost of Ownership (TCO) Strategies

In 2026, your profit margin is determined by how well you manage TCO. You must move beyond “Acquisition Cost.”

The Formula: TCO = P + O + M + I + D – R

- P (Price): Initial cost.

- O (Operating): Fuel/Energy.

- M (Maintenance): Repairs/Tires.

- I (Insurance): Premiums.

- D (Downtime): Lost rental revenue.

- R (Resale): Value at the end.

Lease vs. Buy Strategy: Your strategy depends on your asset type.

- Luxury Cars (Sedans/SUVs): LEASE.

- Why? You need new cars to impress clients. Hold them for 2-3 years. Leasing offers an 8-12% TCO advantage. You avoid the steep depreciation curve.

- Heavy Trucks (Class 8): BUY.

- Why? These last for 10 years. Buying gives you equity. You can use Section 179 tax deductions to write off $1.16 million in the first year. This offers a 15-20% TCO advantage.

Key Takeaway: Don’t be emotional. Let the math decide. Lease the assets that lose value fast (cars). Buy the assets that hold value (trucks).

Deep Dive 3: The "Digital Dentist" (Predictive Maintenance)

Old school rental companies fix things when they break. This is “Reactive Maintenance.” It is a disaster for availability.

The New Way: Predictive Maintenance. Think of this like a digital dentist. You don’t wait for your tooth to fall out. You monitor it. Rentrax integrates with Telematics sensors.

The Workflow:

- The Sensor: Measures engine vibration or battery heat.

- The Data: Sends a code to Rentrax. “Vibration anomaly detected.”

- The AI: Predicts failure in 7 days.

- The Result: You schedule the repair for Tuesday (a slow day). You avoid a breakdown on Friday (a busy day).

The Financial Impact: This strategy reduces maintenance spend by 20-25%. More importantly, it increases your Uptime. If your car is in the shop, it isn’t making money. Predictive maintenance keeps it on the road.

Key Takeaway: Use sensors to listen to your fleet. Fix small problems cheap, before they become big expensive problems.

Deep Dive 4: Regulatory Armor (Compliance & Waivers)

In 2026, the government is very strict. One mistake can shut you down.

The Digital Waiver: Rentrax includes a Digital Waiver System.

- The Process: The customer signs the liability waiver on their phone before they arrive.

- The Storage: The signature is timestamped and stored forever.

- The Value: If they crash the car and sue you, you have instant, defensible proof they accepted the risk.

The DOT Clearinghouse (For Heavy Fleets): If you rent trucks, you must check the Drug & Alcohol Clearinghouse.

- The Rule: If a driver fails a drug test, they are “Prohibited.” You cannot rent to them.

- The Risk: If you do, you are liable.

- The Solution: You must run a query on every driver. Rentrax helps you organize these records in the Driver Qualification File (DQF).

Key Takeaway: Paperwork is your shield. Digital waivers and automated background checks protect your business from “Nuclear Verdicts” (lawsuits over $10M).

Deep Dive 5: Future Fuels (EVs and Hydrogen)

The assets you rent are changing. You need to know what to buy.

The Luxury EV Shift: Corporate clients demand green fleets. You need cars like the BMW i5 (310 miles range) or the Lucid Air (480 miles range).

- Rentrax Feature: You must track State of Charge (SoC). Rentrax logs the battery level at checkout and return. If a customer returns it empty, the system automatically calculates the recharging fee.

The Hydrogen Frontier (Long Haul): For heavy trucks, batteries are too heavy. Hydrogen is the winner in 2026.

- Tech: Daimler’s GenH2 truck uses Liquid Hydrogen.

- Range: Over 1,000 km on one tank.

- Refueling: 15 minutes (same as diesel).

- Strategy: If you run long-haul rentals, plan for Hydrogen infrastructure.

Key Takeaway: Match the fuel to the mission. EVs for city luxury. Hydrogen for long-haul logistics.

Phase 4: Optimization

The 2026 Rental Success Checklist

- Operational Foundation

- [ ] Deploy Rentrax: Centralize all inventory to stop double-bookings.

- [ ] Go Mobile: Enable “Zero-Click” bookings for customers on their phones.

- [ ] Digitize Waivers: Never let a vehicle leave without a digital signature.

- Financial Setup

- [ ] Automate Deposits: Set up credit card holds for security deposits.

- [ ] Recurring Billing: Activate auto-invoicing for long-term rentals.

- [ ] Dynamic Pricing: Use AI to raise rates during holidays/events.

- Asset Management

- [ ] Install Telematics: Budget $150k for hardware if you are a large fleet.

- [ ] Predictive Maintenance: Connect sensor data to your repair schedule.

- [ ] Lease Smart: Lease luxury cars (3 years); Buy heavy trucks (10 years).

- Legal & Compliance

- [ ] Clearinghouse Checks: Run drug checks on all CDL drivers.

- [ ] Permits: Secure Ohio/State hauling permits for oversize loads.

- [ ] Insurance: Use telematics data to negotiate lower premiums (“Resilience-as-a-Service”).

Glossary of Key Terms

- Ghost Inventory: When software shows an item is available, but it is actually broken or missing.

- TCO (Total Cost of Ownership): The complete cost of an asset (Purchase + Fuel + Repair – Resale).

- Book-and-Burn: A construction rental model where hours used are deducted from a project budget.

- Telematics: Hardware that sends data (speed, location, faults) from the vehicle to the software.

- Nuclear Verdict: A lawsuit judgment exceeding $10 million, a major risk in 2026.

Final Strategic Thought

The rental business in 2026 is high-stakes. The difference between profit and bankruptcy is Asset Utilization. If your cars sit on the lot, you lose. If they are in the shop unexpectedly, you lose.

Rentrax is the tool that maximizes utilization. By syncing your inventory, automating your maintenance, and streamlining your payments, it ensures your fleet is always moving and always earning. Don’t just manage your fleet; optimize it.